Flareaccount.com – The prepaid debit card ACE Flare functions similarly to a checking account. You may load the amount you need onto the card instantly. The ACE Flare card functions similarly to a debit card. Wherever Visa is accepted, you may use your ACE Flare Card.

www.flareaccount.com – Flare Account Prepaid Card Review

Table of Contents

- 1 www.flareaccount.com – Flare Account Prepaid Card Review

- 2 Login | ACE Flare Account

- 3 Methodology for Creating a User Account

- 4 Did You Forget Your Password Or Username?

- 5 Activation Procedure Online

- 6 Call in for Card Activation

- 7 No Required Minimum Balance

- 8 Mobile app for ACE Flare Account from MetaBank

- 9 Support That Is Easily Accessible

- 10 In What Ways May The Ace Flare Prepaid Debit Card Serve You?

- 11 About Login | ACE Flare Account

- 12 ACE Flare Account by MetaBank – FAQs

You may charge as much as you want to your ACE Flare Account without worrying about a high interest rate. When using an ACE Flare Card, it’s important to keep an eye on your spending and withdrawal limitations. After logging in, you can do things like check your balance, see your transaction history, send money to loved ones, utilize a pre-funded check, and deposit cash using mobile check capture.

The prepaid card that earns interest is issued by MetaBank and is known as the ACE Flare Account. It offers attractive benefits, such as early Direct Deposits and savings accounts with an optional APY of up to 5%. To avoid the monthly cost and be eligible for free withdrawals, you must adhere to certain Direct Deposit rules.

Login | ACE Flare Account

Your ACE Flare account has many entry points. Sign up for Direct Deposit of your paycheck or government benefits to deposit money into your account. Funds may be added at any ACE location. Make a payment into your Flare account from your regular bank account.

Like a bank account, ACE Flare is a prepaid debit card. Put the cash you plan to spend right onto the card. The Ace Flare card can be used in the same ways as a regular debit card can. It may be used everywhere Visa debit and credit cards are accepted. You may charge as much as you want on the ACE Flare Account since it doesn’t accumulate any interest.

The ACE Flare Card includes restrictions on both purchases and cash withdrawals. Internet activation of ACE Flare Cards is quick and simple. You’ll need the card number and verification code to use them. To access your account details, please use the login instructions provided below.

Methodology for Creating a User Account

You may access the ACE Flare Login page at aceflareaccount.com. The ACE Flare app is available for both Android and iOS devices. MetaBank backs this application. This software allows users to manage their bank accounts and submit loan applications.

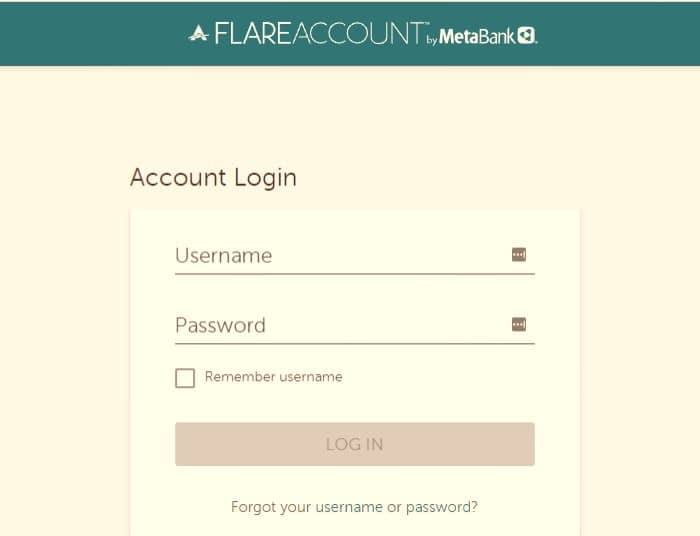

Once you’re familiar with the procedure, you may log in whenever and anywhere you choose. If you need help logging into your account, a comprehensive tutorial is at your disposal.

- Visit the sign-in page for your account at www.aceflareaccount.com

- When you first load the website, you’ll see a “Sign In” option at the top.

- Put your login information in the blanks.

- Simply choose the ‘Login’ option to enter your account information and begin the login process.

- Keeping your login in the browser’s memory is as simple as checking the ‘Remember username’ box.

- If you have forgotten your username or password for your account, you can easily reset it by following the instructions below.

- To get started, go to the ACE Flare Login page.

- The ‘Forgot password?’ option is located just under the login form, in case you ever forget either your username or password.

- When you click on it, you’ll be brought to the next page.

- Enter your email address here if you have forgotten your username.

- By entering your login and email address, you may get your password reset.

Did You Forget Your Password Or Username?

Go to the ACE Flare Login page to get started.

The ‘Forgot your password?’ option is located just under the login form, where you may retrieve both your username and password.

- If you choose it, you’ll go to the next section.

- If you have forgotten your username, enter your email address in the space given.

- Please enter your username and email address to reset your lost password.

- The ACE Flare Card and How to Use It.

- The ACE Flare Card may be used in one of two main ways. The card may be activated by the following means:

Activation Procedure Online

Online activation is quick and simple with ACE Flare. Your card’s activation requires both the card number and security code. Here are the simple measures you must take to activate your ACE Flare debit card:

- Follow this URL www.aceflareaccount.com/activate to verify your email and activate your account.

- After clicking the aforementioned link, you will be brought to the card activation page.

- Enter the card number and security code into their respective boxes.

- When finished filling out the necessary information, click the Continue button.

- The activation process then just requires the user to follow the on-screen prompts.

Call in for Card Activation

The ACE Flare Card may also be activated over the phone. You may acquire that data by dialing 1-866-753-6355 from your phone. After dialing this number, all you have to do is listen to and follow the voice prompts. Your payment information, so that you may make a payment, should be kept close to hand.

Features

The debit cards linked to ACE Flare Accounts come with a number of perks and conveniences. You may submit an application for the card on the official website (www.aceflareaccount.com). You may apply for a license in addition to sending and receiving money, seeing transaction histories, and doing many other things.

No Required Minimum Balance

The ACE Flare Account from MetaBank is a great option since it requires no initial deposit and has no minimum balance restriction. Since there is a monthly cost for inactivity (see above), you shouldn’t let it remain idle.

Collect Interest

Let’s get this straight from the get-go. The rate of return is low since your money is not part of a pooled investment vehicle. Nonetheless, you do receive value for your investment. Currently, MetaBank’s ACE Flare Account gives a paltry yearly percentage return of 0.01%. Although this isn’t much, the ACE Flare Account by MetaBank Savings Account gives you access to higher interest rates.

Mobile app for ACE Flare Account from MetaBank

The ACE Flare Account by MetaBank mobile app is available for download on both iOS and Android platforms. The app’s simplicity belies its ability to keep you going. The optional Netspend Pre-Funded Check Service allows you to do all of the same things as transferring money to others, depositing checks, monitoring your balance, and seeing your purchase history. I enjoy that the app notifies me through text messages whenever an event of interest occurs in my account.

Support That Is Easily Accessible

ACE’s support team may be contacted through phone or electronic mail. One of the issues, though, was that the business hours weren’t clearly stated. You are, in effect, taking a chance.

Digital receipts

Just like paper bank statements, your online account statements are accessible for viewing at any time. It’s important to remember that ACE will only send you physical statements if you opt out of receiving electronic ones.

If you want to avoid paying the $5.95 fee, sign up for electronic statements right now. If you have any transactions during the month, you will get a statement; otherwise, you will receive a statement every three months.

In What Ways May The Ace Flare Prepaid Debit Card Serve You?

The prepaid debit card ACE Flare functions similarly to a checking account. The funds will be loaded onto the card instantly, making them available for use at any time. In addition, the card may be used in the same ways as a standard debit card. It’s valid at any store or restaurant that takes a Visa.

The ACEFlare Account from MetaBank does not provide a high-interest rate (though your balance will earn some interest), but you are free to make up to 20 purchases per month. It is crucial to understand the card’s restrictions before making any purchases or withdrawals.

You may spend up to $5,000 in one transaction using a pin-based system (like a debit card). In addition, you may make cash withdrawals of up to $5,000 at the counter (rather than through an ATM). When using an ATM, your daily withdrawal limit is $1,000, and each individual transaction is restricted to $400.

In addition, you may use the card to enroll in a bill payment service. Set up monthly payments from your ACE FlareTM Account by MetaBank to your Verizon account so you may avoid late fees. Be careful, however, that certain places (like municipal utilities) may tack on a fee if you pay with a debit card.

About Login | ACE Flare Account

The Irving, Texas-based ACE Cash Express, Inc. is a financial services business. Money orders, bill payments, money transfers, check cashing, and prepaid debit cards are just a few of the many financial services offered by ACE. Through its brick-and-mortar locations and digital platforms, this business caters to clients in twenty-four different states and the District of Columbia.

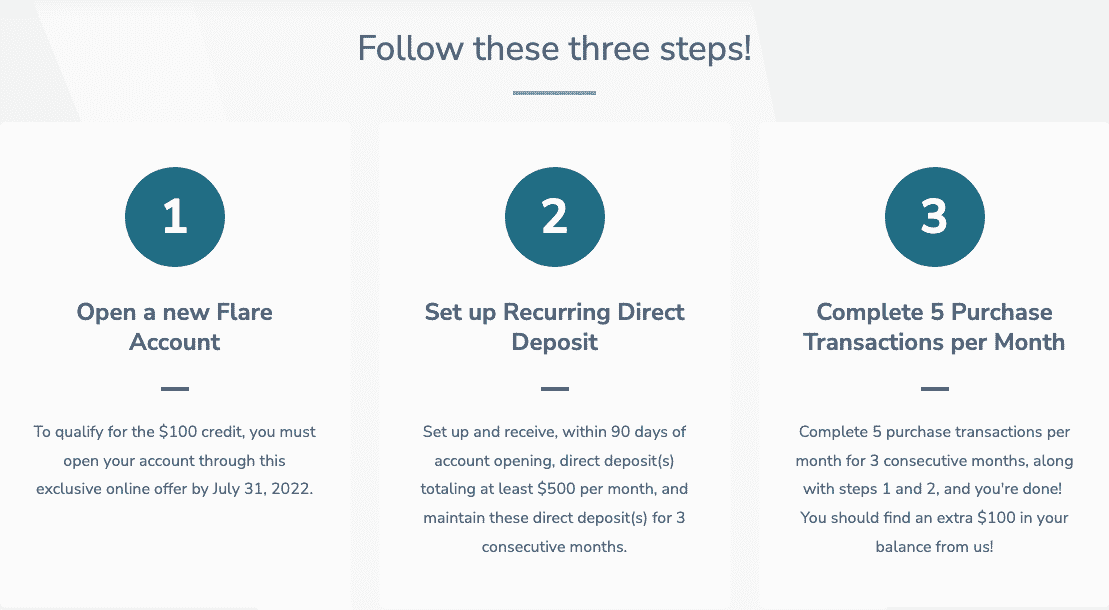

ACE Flare Account by MetaBank users get access to a number of benefits once logged in. If a new member deposits at least $500 per month, they may take advantage of the cheap monthly fees and straightforward application and enrolling procedure. If you’re searching for a prepaid card that pays interest, the ACE Flare Login Account might be just up your alley.

Since its founding in 1968, ACE Cash Express has been a go-to for customers seeking non-traditional banking services. Check cashing, bill payment, money transfers, and prepaid debit cards are just some of the services offered by ACE Cash Express.

ACE Cash Express is the parent company of some of the major check-cashing franchises in the United States. Customers who prefer not to maintain long-term bank connections may turn to ACE for quick and easy access to banking services.

The National Association collaborated with Netspend and MetaBank to design and implement ACE Cash Express’s cutting-edge, feature-rich bank account. Our banking services are designed to be as easy and stress-free as possible for you.

Now that you have access to the resources you need, banking is a thing of the past. MetaBank’s telephone and online ACE Flare Account opening services are both free of charge. If you apply for a card in person, you’ll have to pay a $3 application fee. An account may be opened with as little as $1.

Final Thoughts

The advantages of using a MetaBank ACE Flare Login Account are many. It’s easy to sign up and get started, and if you deposit $500 or more per month, your expenses will be minimal. If you’re searching for a prepaid card that allows you to earn interest on your funds, the ACE Flare Login Account might be a good option.

ACE Flare Account by MetaBank – FAQs

- Question – Is there a way to use Direct Deposit with my ACE Flare Account?

Answer – Many of Flare Account’s finest functions are unlocked when you use Direct Deposit for receiving your salary and government benefits. You can be paid up to two days sooner2 with direct deposit, make no-fee3 cash withdrawals of up to $400 per day at certain ACE locations, have access to an optional High Yield Savings Account4, and use an optional Debit Card Overdraft5 service

- Question – When will my debit card arrive?

Answer – Your replacement card will arrive in 7–10 business days, on average. Your mailbox should have included a letter from the ACE Flare Account by MetaBank. If it hasn’t come after 10 business days, please contact them at 866-753-6355.

- Question – I have an Optional Savings Account; how can I make interest?

Answer – If you have a qualifying monthly Direct Deposit, you may earn up to 6.00% APY by opening a Flare Account Savings Account. As a result, your savings might really make you money while doing nothing more than sitting in your account. Your exact APY will depend on a number of variables, including your ADB.

- Question – What do Payback Rewards include, and how can I get them?

Answer – Your new account now has access to the Payback Rewards program. You can see what deals you’re eligible for by visiting the Rewards section of the Online Account Center or the Mobile App after logging in. Simply activate the deals you’re interested in using your card at the associated stores to get the discounts. Your rewards will be added to your account at the end of the next month.

- Question – Where can I find out how to make a cash withdrawal?

Answer – Withdrawing money from an ATM with a standard debit card costs the same flat fee of $2.50 as doing it at a bank. Free daily withdrawals of up to $400 are available at certain ACE Cash Express locations with proof of qualifying Direct Deposit activity.

Related Tag:-